The term synthetic asset implies a mix of assets that have a comparable worth as another asset. Generally, counterfeit materials unite diverse auxiliary things options, prospects or exchanges that reproduce a secret asset stocks, protections, items, records, money related principles or credit expenses.

Computerized cash based synthetic assets intend to give customers receptiveness to a wide scope of assets without hoping to hold the essential asset. This could be anything from fiat money related guidelines, similar to the United States dollar or the Japanese yen, to things like gold and silver, similarly as document holds or other progressed assets.

By using these intriguing synthetic assets, monetary sponsor can regardless hold tokens that track the value of specific assets without hoping to leave the cryptographic cash natural framework. Crypto syntheticassets moreover offer customers all of the benefits of decentralization, as they are accessible to all customers across borders by using got insightful arrangements and various instruments, and the data is taken care of on appropriated records.

About

TES is a social occasion of used synthetic asset sets made and tokenized on Ethereum without the threat of liquidation. The target of TES is to give decentralized, trustless and non-KYC technique used assets that act nearly to standard used ETFs. Trading using impact is successfully used and known to every vendor. Contingent upon a resource or commitment rebalancing, there is a consistent achievement of impact. What makes a difference is that TES assets don't require various kinds of rebalancing, likewise the risk of getting an edge call is confined.

The system gives striking benefits. TES assets are passed on in pairs and have a couple of assurance sources. They are driven by the liquidity providers, ETH, which is relied upon to mint tokens, and clearly, by the benefit of an opposite asset. Maybe than agents, crypto vendors already couldn't use used ETFs.The system needn't mess with a specific counterparty, since the entire capital of liquidity providers and the "LONG" token is the most grounded counterparty for the "SHORT" token. TES gives a zero peril of liquidation for used trading. Assets hold 100% lifetime liquidity since token sets are isolated. Any sharp worth improvement not a tiny smidgen impacts the liquidity of the entire structure.

The setback of constraints on the amount of made assets grants them to make an effort not to rely upon a security pool. Holders who stake on liquidity providers and tokens will get a transport of commissions from buying and selling assets. TES cares for records, products and assets with public decentralized prophets.

Customers are permitted the opportunity to offer liquidity to any match of TesECO assets. It is basic to observe that there is a differentiation between TES stamping and liquidity game plan. Customers offer liquidity to only one arrangements of assets, which infers they in like manner get a commission from only one sets. Commissions from the entire TesECO natural framework should be secured when TES stamping. The endeavor will offer an opportunity to pull out acquired interest two or three assets at whatever point without dropping liquidity. Long and Short liquidity tokens have viably been added to the limit contract. These tokens are seared when liquidity is taken out and can't be moved.

How to Work?

The essential differentiation from traditional impact is that Long, Short tokens are supported by ETH.The more ETH on store — the more tokens with impact. In like manner, the assets reliably have 100% liquidity. Using this decentralized model, the genuine impact of a given token Long or Short is rarely 3x — yet it will not at any point be above 4.5x or normally underneath 1.5x. You can see the genuine impact in the "Experiences" part of the application.

Mission

TesECO's primary objective is to make an extraordinary thing for the cryptographic currency market, organizing the foundations of the financial instruments of the customary theory market. As opposed to standard vendors, crypto handles previously couldn't use used ETFs. TES's principle objective in the domain of advanced monetary forms is to ensure zero liquidation risk in used trading.

TesECO concept

TesECO the working norm of the stage: fabricated impact without the need to go through KYC technique with the liquidation risk excepting. Frameworks organization is done using Chainlink prophets, which infers TesECO can maintain impact with any of the sets in the Chainlink feed. The initiated tokens were first introduced on FTX (auxiliaries exchange), where they gained their pervasiveness. This licenses you to scatter chances by purchasing a representative that goes probably as a figure, if ETH creates by 1.5%, ETHLONG will create by 4.5% and the reverse way around. This thought is celebrated, anyway the FTX Exchange requires the KYC procedure, which to some degree renounces one of the fundamental foundations of cryptographic types of cash — lack of definition. TesECO's task is to allow to crypto specialists without the need to go through KYC methodology.

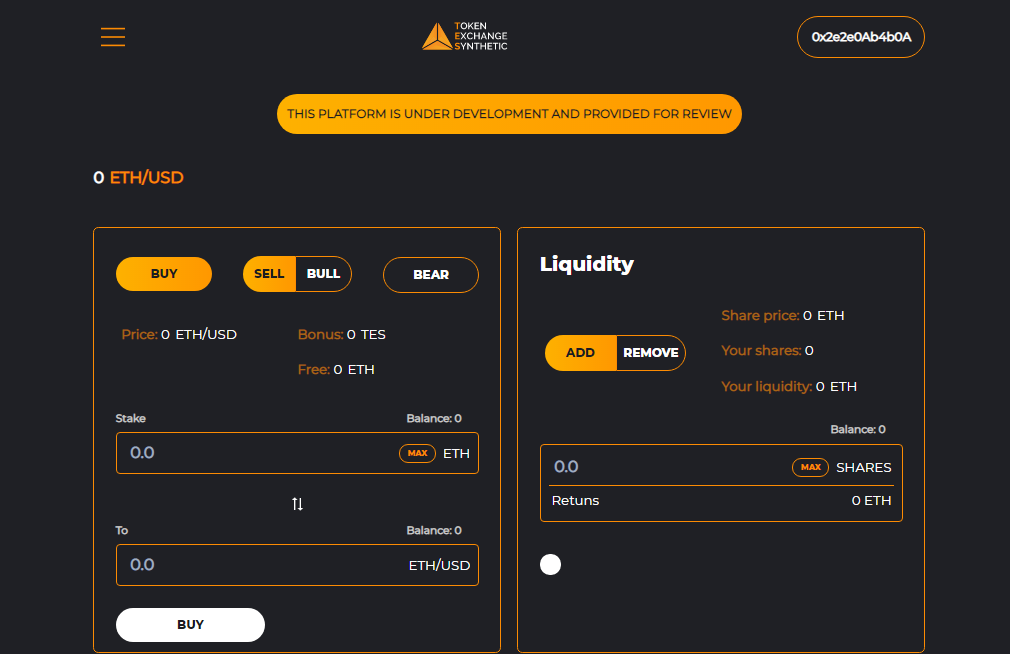

It is exceptionally easy to purchase Long and Short tokens with the TesECO interface. Basically select Long or Short in the portion "Trading" and subsequently put in your solicitation. On account of the estimation of the stage, you can see the Long/Short harmony persistently. If more people own Long tokens, the impact for Short additions, and the reverse way around. Likewise, if the tantamount for one of them ends up being significantly greater than for the other one, disciplines and rewards are constrained so the impact stays inside an acceptable reach.

Liquidity pool

In the right corner of the application, you will see a "Liquidity" fragment. This is where customers can give liquidity and get commissions on the stage. By virtue of adding ETH liquidity, liquidity is given by ETHLONG and ETHSHORT tokens through the TesECO amassing contract. They furthermore devour when a comparative liquidity is taken out. Later on, other than Ethereum, there will be even more Long and Short tokens for computerized types of cash. It should be seen that adding liquidity to the pool simply brings you advantage for this particular pair of assets. Staking Tes brings you pay for the entire natural framework for all arrangements of assets. By adding liquidity, you get shares. You can see the offer expense and sum with liquidity that you own in the "Pool" portion of the application.

TES Token

The TES token goes probably as a part of the TESECO organic framework. Customers who buy and sell TES assets produce commission. Prizes are made for staking from half of these commissions. Since the organization of the "TesECO" project is concentrated, TES can't be an organization token. The progression resource will from the outset get all made stamping costs before the stacking is unreservedly allowed.

The best number of TES is 10 million. The shortfall of a fundamental offer and the protection of 100% liquidity is a direct result of the way that all TesECO assets are printed for ETH at the current expense of the produced token. It is from the sharp amassing that all tokens that are bought and sold pass on a commission of 0.4%. Those TES token holders who place their tokens will be allocated all resulting commissions.

Website : https://tes-token.com/

Whitepaper : http://tes-token.com/TES_WP.pdf

Twitter : https://twitter.com/TESyntetic

Telegram : https://t.me/TesEC0

GitHub : https://github.com/TESECO/TES-token

AUTHOR

BTT username: vasilisc55

BTT profile link : https://bitcointalk.org/index.php?action=profile;u=2561314

ETH: 0xe4baa1588397d9f8b409955497c647b2ede9defb

Комментариев нет:

Отправить комментарий