FLETA Blockchain with novel Proof of Formulation to overcome limitations of Ethereum and EOS

FLETA is a blockchain platform that is developed to deal with problems of existing blockchains such as scalability, speed or decentralization. Fleta aims to become a platform to build DApps which can independently operate regardless the increase in activity on sub-chains.

1. Technological idea

FLETA is a blockchain platform that is developed to deal with problems of existing blockchains such as scalability, speed or decentralization. Fleta aims to become a platform to build DApps which can independently operate regardless the increase in activity on sub-chains. Some innovative features of Fleta include: a novel consensus mechanism, Proof of Formulation, Multi-chain architecture and Sharding.

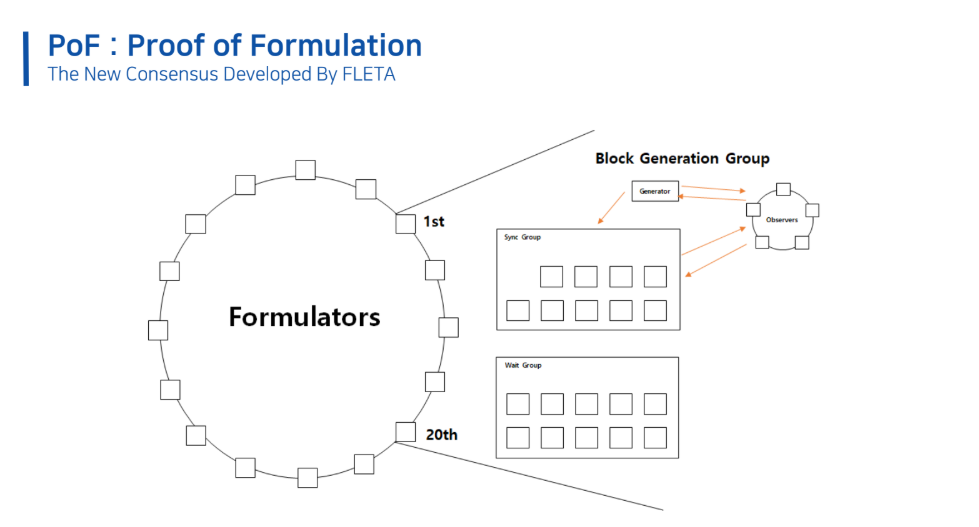

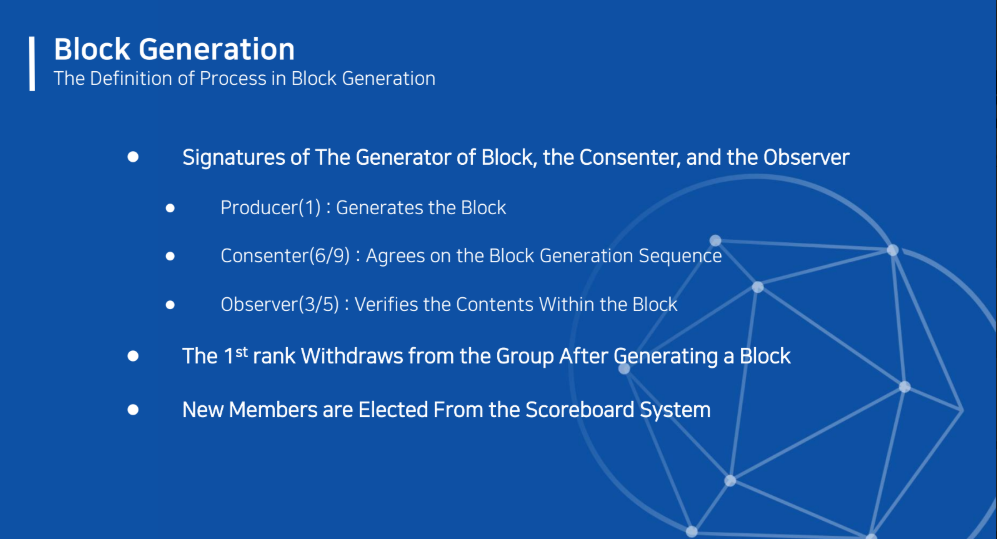

In Proof of Formulation, there will be formulators who are in charge of block generation and observers who are responsible for verifying the blocks and consenters who decide the block generation sequence. There will be a group of 20 formulators and their rankings will range from 1 to 20 based on their score. The score will determine their mining sequence and the reward sequence. The score is calculated as follows: Score: Absolute ([Formulator Transaction generation block, last compensated block] the hash from the last block thereof — the hash from 100 blocks before that block) + (Current time — [Formulator Transaction generation block time, Discovery time, last compensated block time] the last value thereof). The formulator with the highest score will become the generator to generate a block. After finishing the block generation, the 1st ranked formulator will go out the formulator list. The 2nd to 19th formulator conduct a vote for the next node to join the formulator list. Here is the process of block generation:

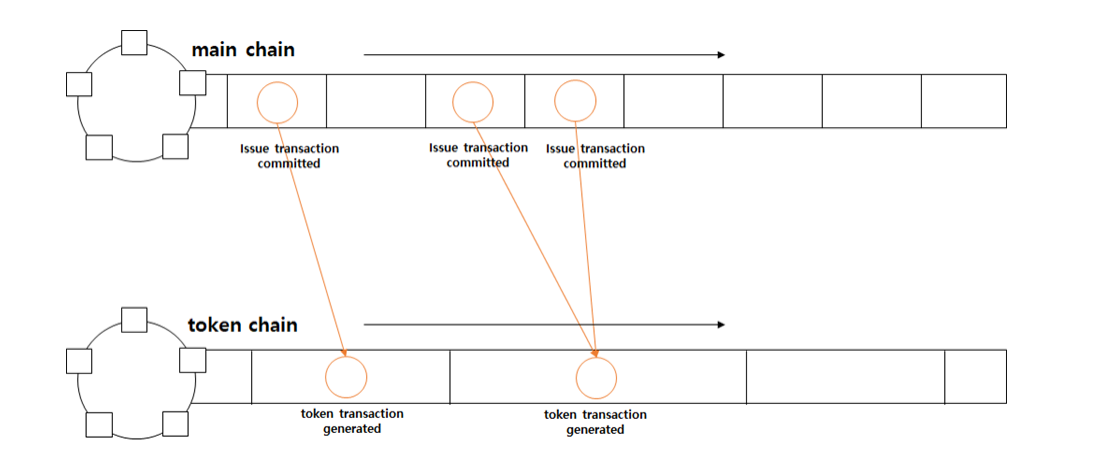

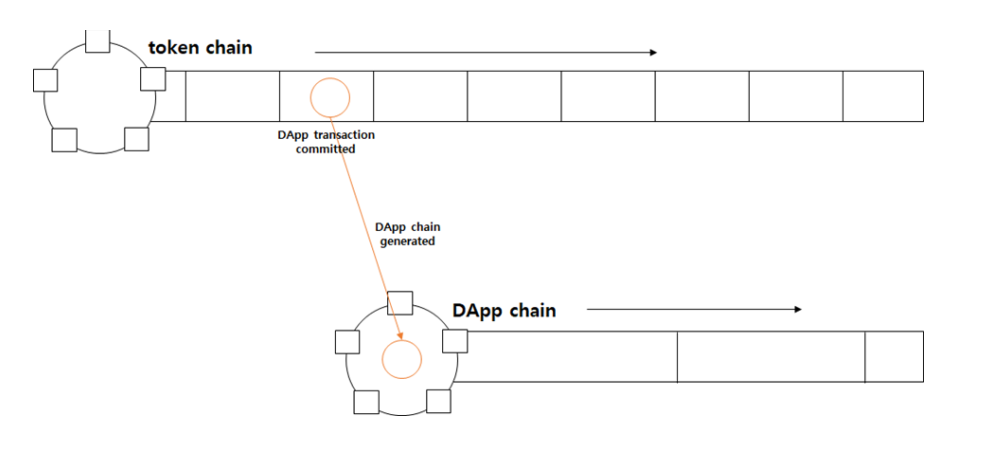

Considering the multi-chain structure, Fleta has Main chain, Token chain and DApp chain.

Main chain is the place where the issue transaction takes place. The issue transaction is defined as the transaction which creates the issue contract and receives the token. The tokens will be traded on the token chain. The token chain also guarantees the process of Issue Transaction by listing the block number and hash value of the main chain to create a new block. Moreover, the token chain can create a sub-chain to run the DApp.

The sharing forms of Fleta includes partitioning data to store it and partitioning transaction to process it. It is stated in the white paper that Fleta can handle 20,000 TPS per shard. With 500 shards, the network is capable of 10 million TPS.

The most attractive point when people hear about Fleta is its new consensus mechanism. However, whether this new consensus mechanism is more effective than the existing mechanism or the team can realize their idea is a matter of time. At the current time, no one can ensure the effectiveness of this new consensus.

2. Team

a. Core team

Seungho Park (CEO): He graduated from Hanyang University. CEO of Firstchain, the company behind Fleta.

Lucas Park (CTO): He is CTO of Firstchain

Peter J (CFO): Section Chief of KJ Bank. CFO of Firstchain.

Gerrard Kim (Marketing leader): Marketing leader of Firstchain.

Henry Hong (CMO): CMO of Firstchain.

b. Advisor

Yoon Kim

Current Senior Advisor of Corent Technology

Former CEO of Motorola Korea

Former CEO of Cisco Systems Korea

Sam Soo Pyo

Current Executive Advisor of Kim and Chang Law Firm

Former Assistant Professor of Syracuse University,

Kentucky University

Former Professor of Myongji University

Former Director of Samsung Electronics

Former CEO of Hyundai Information Technology

Former CEO of Oracle Korea

Kyung Mo Lee

Current Chairman of KEMITS

Current Chairman of ITT

Former Chairman of SEMYUNG Industrial Co.

Former Economic Advisor of the Blue House

Former Chairman of Shinhan Investment Corp

Dong Yun Lee

Current Advisor of Mirhenge

Former President Office Director of IBM AP Headquarters

Former CEO of DAEBO Communication & Systems

Hae Won Choi

Current President of Linn Consulting

Former President of SQ Tech

Former Executive Director of IBM Korea, GM of Banking

Finance Industry

Young Jin Son

Current CEO of Cisco Korea

Former CEO of Microsoft Korea

Former CEO of Korea Data General

Du Hee Lee

Current CEO of LIKELION

Former Co-founder of Kongdoo Company

Former CTO of Ultracaption

Talented Programmer from Seoul National University

Appearance at The Genius, a TV show

The advisor team seems to be well-known people in different fields. However, none of them has direct experience in developing any ICO projects.

There is little information about the core team. Also, their experience in LinkedIn is limited. They seem to work together in the company called Firstchain, but there is no reference information to that company. We don’t know why they need to keep the information secret. Other projects from Korea can still show the information about the team so maybe there is no constraint considering the legal issue. The question is that: Is there any problems the team do not want to show to the public? Why do they show off information about the advisors but publish nothing about the team in the website and white paper?

3. Token Economy

Hardcap: 30 million USD

Total Token Supply: 10B

Private & Public Sale: 2.5B (25%)

Reserve Fund: 4.2B (42%)

Marketing: 1.0B (10%)

Advisors & Partners: 1.0B (10%)

Founders & Teams: 1.3B (13%)

There is up to 42% for reserve fund. The reserve fund will be used to keep the value of ecosystems and holders, such as exchange issues, token exchanges with other DAPPs, and investments in DApp projects. This figure is really high. How could investors check the usage of half of the token (42%)? As it can be seen in the roadmap below, until 2020, there is still no plan to develop any DApp.

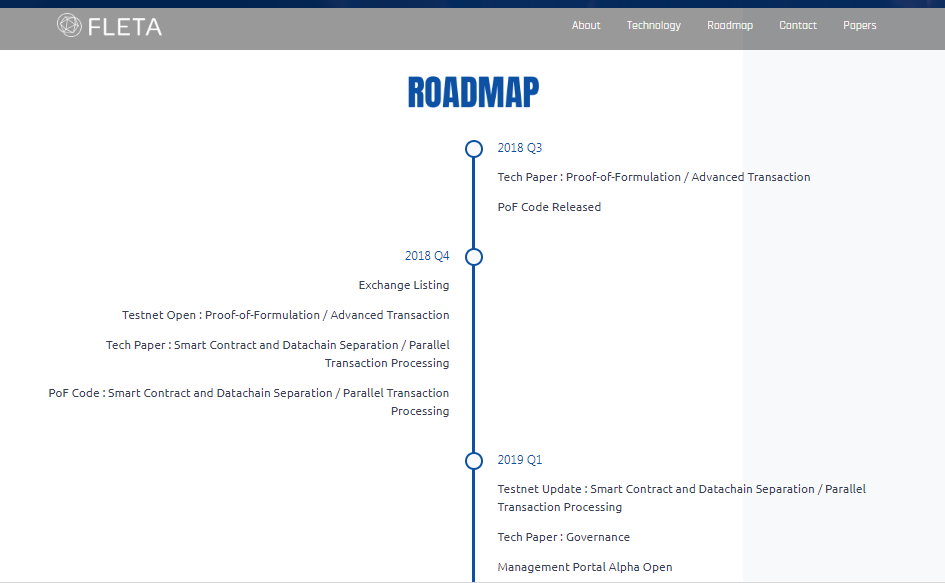

4. Roadmap

2018 Q3

Tech Paper: Proof-of-Formulation / Advanced Transaction

PoF Code Released

2018 Q4

Exchange Listing

Testnet Open : Proof-of-Formulation / Advanced Transaction

Tech Paper : Smart Contract and Datachain Separation / Parallel Transaction Processing

PoF Code : Smart Contract and Datachain Separation / Parallel Transaction Processing

2019 Q1

Testnet Update : Smart Contract and Datachain Separation / Parallel Transaction Processing

Tech Paper : Governance

Management Portal Alpha Open

2019 Q2

Mainnet Open : Token Swap

Testnet Update : Governance, Grid Bucket

Management Portal Beta Open

Masternode Exchange Alpha Open

2019 Q3

Mainnet Update : Governance, Grid Bucket

Testnet Update : Realtime Router, Distributed Log

Management Portal Open

Masternode Exchange Beta Open

2019 Q4

Mainnet Update : Realtime Router, Distributed Log

Testnet Update : Service and Sever Resource Monitoring

Masternode Exchange Open

Game Project Alpha Open

2020 Q1

Mainnet Update : Service and Sever Resource Monitoring

Game Project Beta Open

The roadmap show the technical development of Fleta. It is stated that the PoF will be released in Q3 2018 but the Github has not been published yet.

The roadmap shows what the team does from Q3 2018. When checking the website https://www.whois.com, Fleta’s website is just registered from 21th June 2018. Fleta is just in its infancy.

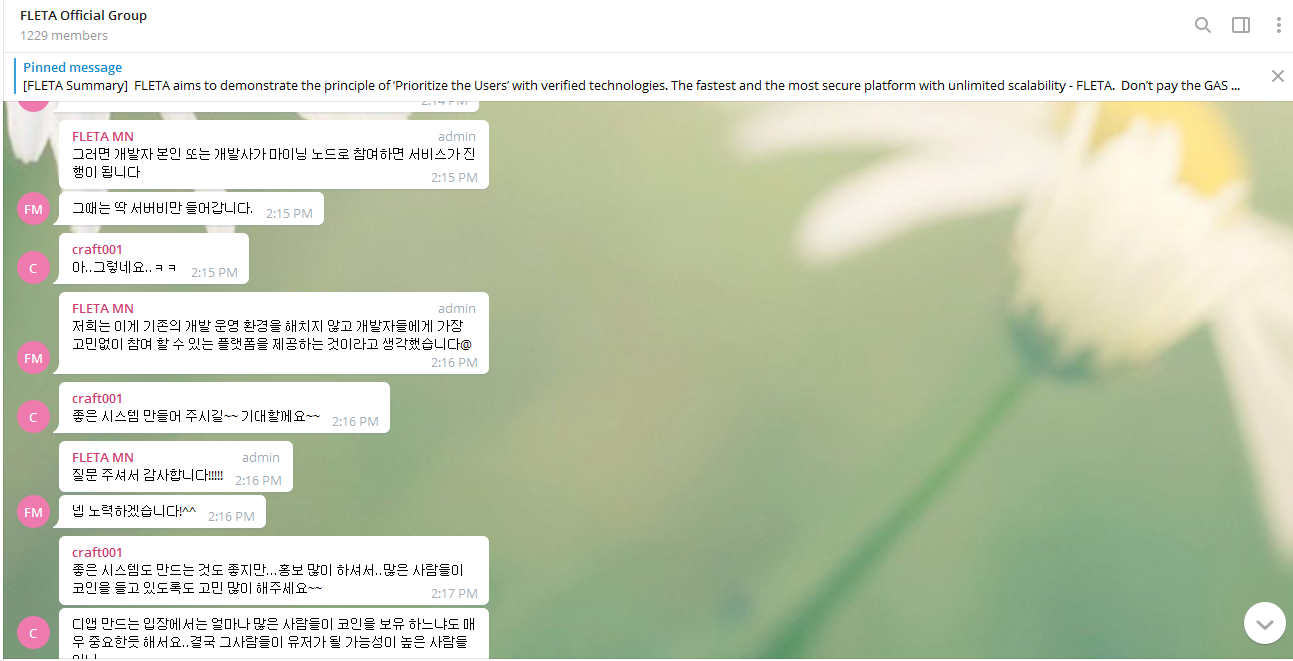

5. Community

Official Telegram group chat: 1,229 members

Kakao group: 564 members

Korean Telegram group chat: 123 members

Fleta has been listed in several ICO sites but there is not year a comprehensive review on this project.

The interaction in the Telegram group chat is not active. At this time, the project hasn’t focused on marketing.

Summary

Advantages

The idea of the project can make people interested. It has a novel consensus mechanism. 10 million TPS is also an acceptable figure in comparison to existing projects.

Things to note

The information about the team is not transparent. The team’s qualification is one of the criteria investors and the community concern most when they look at a project. However, the community may not believe in the ability of the team due to the lack of information.

There is no MVP or Github published at this time. It will be difficult for the team to persuade everyone that the team is focusing on developing the technology.

The token economy is not appropriate. They’d better not spend a huge amount of token for reserve fund, especially when the market is bearish currently, the investors want something clear and evident.

The marketing strategy is not really smart. Even if the project is registered in Korea and the core team is from Korea, they start marketing in Korean market. In the Telegram group chat, there are many people chatting by Korean language instead of English. Admins sometimes update information in Korean. They should have a local Telegram group chat if they want to focus on a specific market. Meanwhile, the official group is for English chatting only.

Conclusion

Although the idea is quite good, there are many issues to consider when we research Fleta as mentioned above. In case the token economy is modified, they have MVP or Testnet to prove the efficiency of their work, and the information about the team is impressive, this project could be a potential ICO project. However, at this time, it is risky to invest in Fleta.

Website: https://fleta.io/

===============================================

AUTHOR

BTT username: vasilisc55

BTT profile link : https://bitcointalk.org/index.php?action=profile;u=2561314

ETH: 0xe4baa1588397d9f8b409955497c647b2ede9defb

Комментариев нет:

Отправить комментарий